May 18th, 2017

How privatizing infrastructure puts corporations before everyday Canadians

Public infrastructure projects like bridges, airports, and public transit keep our communities running smoothly. When it comes to building new infrastructure, we expect the government to put the needs of everyday Canadians first – period.

This is why the Liberals’ proposed infrastructure privatisation scheme – the Canada Infrastructure Bank – is so concerning. If this plan goes ahead, private money from rich investors like BlackRock will be used to fund the projects our communities rely on.

A corporation has one goal: to make money. And yet, the Liberals want to hand private investors and multi-national corporations more control in planning and building essential infrastructure projects – like the roads and buses we take to and from work every day. With corporations at the wheel, what’s best for Canadians will come second to turning profits.

Infrastructure built by private investors will cost taxpayers more

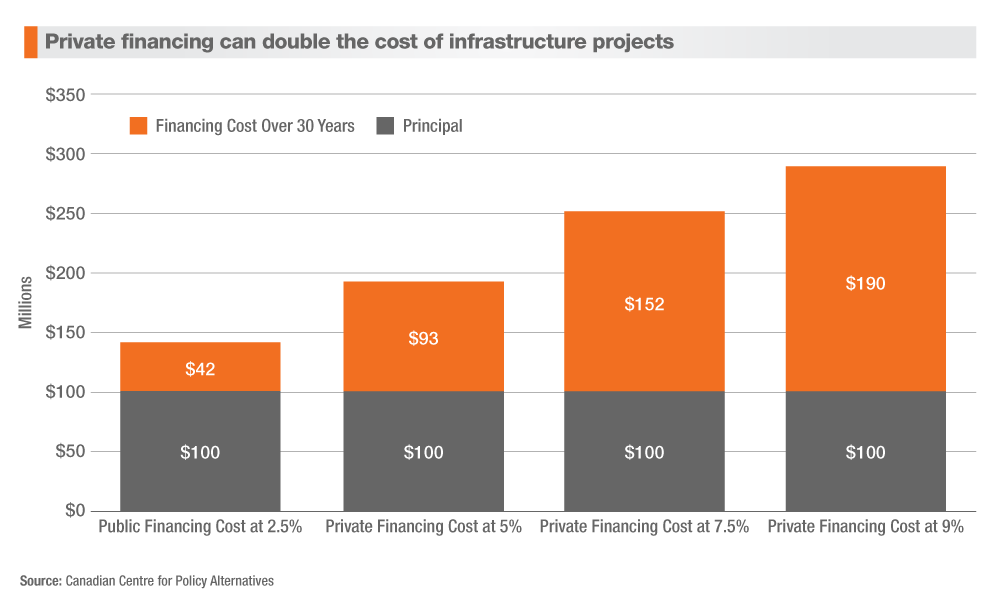

Private funding could double the cost of infrastructure projects – and taxpayers will have to cover the higher price tag.

To fund the projects our communities need most, the government typically borrows at a preferred interest rate of 2.5%. But private investors expect returns of 7% to 9% on their investments in public projects.

“No homeowner in their right mind would commit to a mortgage at a rate of 7% or more when they can borrow at 2.5%... So why would the federal government make the Canada Infrastructure Bank rely on higher-cost private finance?” – Economist Toby Sanger, CUPE

The government’s responsibility is to make sure Canadians get the best deal, not generate huge profits for their wealthy friends while taxpayers foot the bill.

Privately-owned and operated infrastructure results in more expensive, lower quality, less accessible services

To meet the demands of rich investors, privately-funded infrastructure projects will have to generate income. This could mean:

- More toll bridges and highways;

- New costs and increased user fees due to privatization of airports, public transit, and utility services.

Struggling families and workers across Canada already pay their fair share and shouldn’t be asked to fill billionaires’ pockets just to use the roads and bridges in their communities.

When private companies own our public infrastructure, we also have less control over how and where projects get built. This could mean:

- Less environmental accountability;

- Less funding for smaller or non-revenue generating projects, like those in rural, northern, and Indigenous communities.

Canadians expect public infrastructure to support their communities – not an investor’s bottom line.

Say no to privatization:

Add your name to protect public infrastructure from private interest.